Bitcoin Halving 2024: A Pivotal Moment for Cryptocurrency’s Future

The cryptocurrency world is buzzing with anticipation as we approach the Bitcoin halving event happening this week. This significant event, occurring roughly every four years, is not just a technical adjustment but also a pivotal moment that could shape the future trajectory of Bitcoin and, by extension, the broader cryptocurrency market.

What is the Bitcoin Halving?

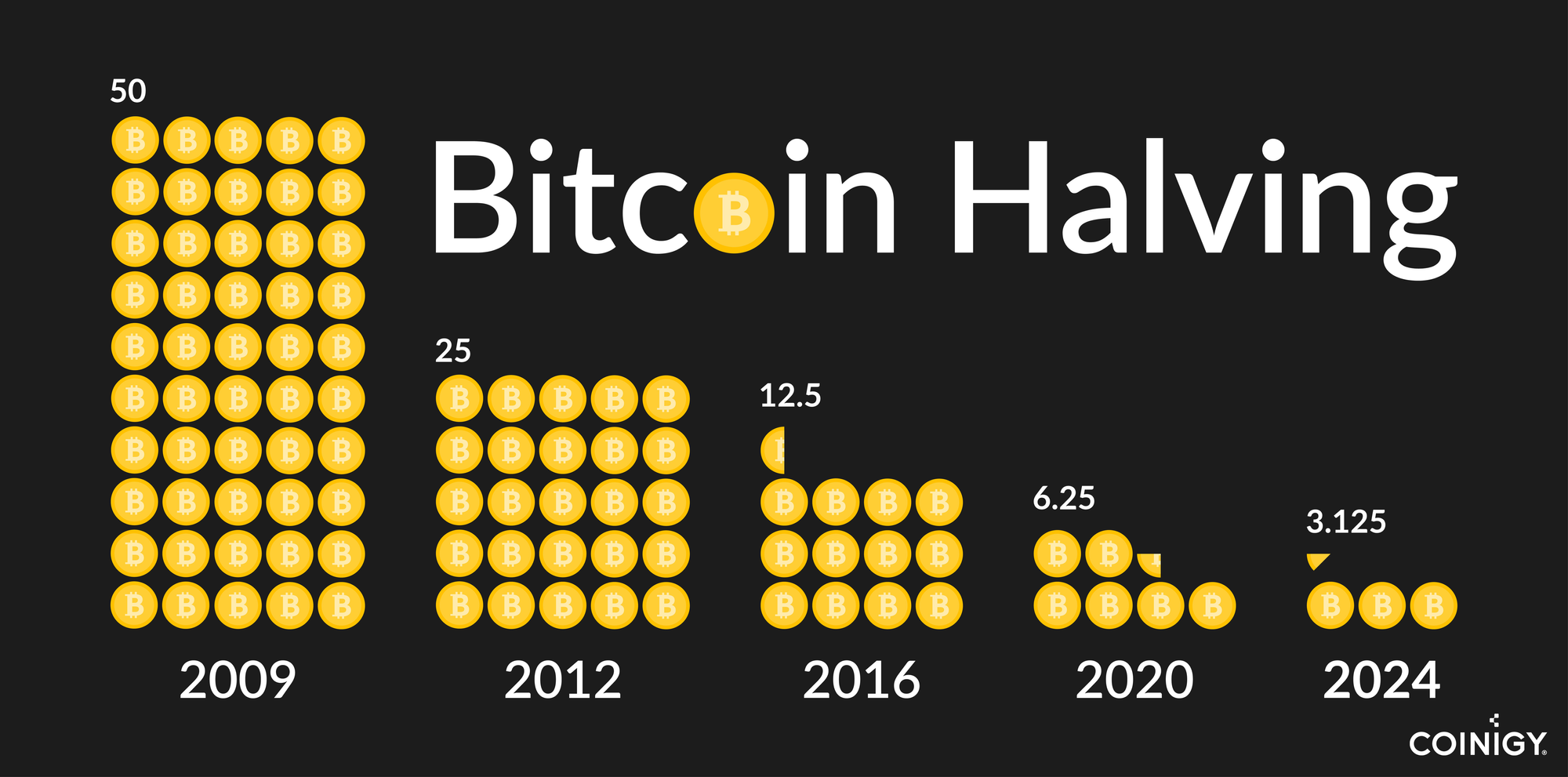

The Bitcoin halving is a predetermined event coded into the Bitcoin network that reduces the reward for mining new blocks by 50%. When Bitcoin was created by the pseudonymous developer Satoshi Nakamoto in 2009, it was decided that the block reward would halve after every 210,000 blocks are mined—a cycle that takes approximately four years to complete.

Initially, miners received 50 bitcoins per block. This figure was first halved to 25 in 2012, then to 12.5 in 2016, and again to 6.25 in 2020. This week, we anticipate the reward dropping to about 3.125 bitcoins per block.

What is the purpose of the Halving?

The primary purpose of the halving is to control inflation. Unlike fiat currencies, which can be printed endlessly by governments, Bitcoin has a fixed supply cap of 21 million coins. The halving mechanism ensures a predictable and decreasing rate of new coins entering the system, thereby controlling inflation and contributing to the asset's scarcity and perceived value.

Why is the Halving Important for Crypto Traders?

Impact on Price: Historically, halving events have been catalysts for significant price movements. The reduction in the rate at which new bitcoins are generated can lead to a supply shock. If demand remains constant or increases, the reduced supply flow can push prices up, a basic economic principle.

Increased Market Attention: Halvings draw increased attention from both the crypto community and mainstream media. This heightened attention can lead to more trading volume and potentially more liquidity, creating favorable conditions for price volatility.

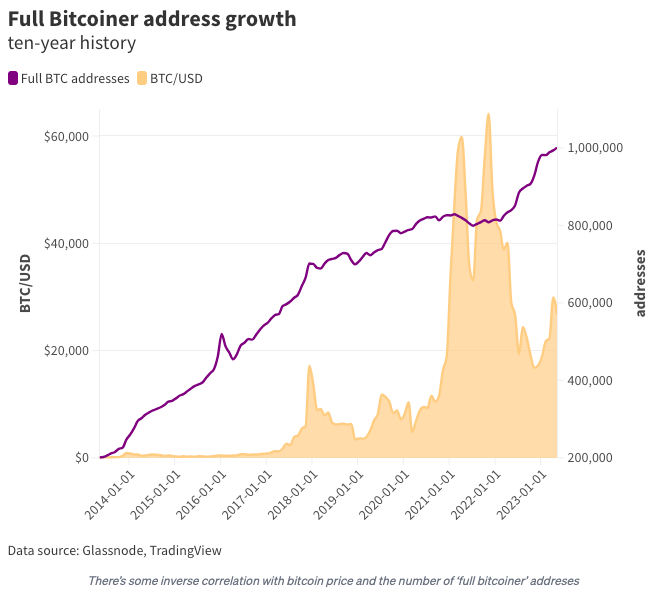

Long-term Implications: For long-term investors, the halving is a reminder of Bitcoin's deflationary nature. As the rate of new coin production slows, Bitcoin could be perceived as more valuable over time, akin to a digital version of gold. The number of addresses that own a full Bitcoin has increased exponentially over the past decade. As Bitcoin becomes more scarce, the price will inevitably go up and become more and more unaffordable.

Preparing for Trading During the Halving

For traders looking to capitalize on the volatility surrounding the halving, using a robust trading platform like Coinigy can be beneficial. Coinigy provides a comprehensive set of tools tailored for trading cryptocurrency. It offers real-time charts across 45 crypto exchanges, a suite of technical analysis tools, and a secure trading environment allowing users to trade across multiple exchanges through a single interface.

As the Bitcoin halving unfolds this week, traders should be ready for possible price fluctuations and ensure they have the right tools at their disposal to manage their trades effectively. Platforms like Coinigy not only enhance the trading experience but also provide the critical data and analytics needed to make informed decisions.

Conclusion

The Bitcoin halving is a cornerstone event in the cryptocurrency calendar that encapsulates the unique economic model and innovation that Bitcoin introduced to the world. For crypto traders and investors, understanding the implications of the halving is essential for navigating the market dynamics it influences. As we look to this week's event, the entire crypto community is on alert for what could be the next big shake-up in cryptocurrency valuation and market structure.