Coinbase Wage War on State Laws as Congress Tackles Tax Regulations ⚖️

Here’s to wallets that are as full as Santa's bag, and portfolios greener than the North Pole's evergreens. 🥂

For starters today, Coinbase is out, taking a dig at state regulations and creating its own consensus layer in federal court. Apparently, prediction markets are a federal matter now.

Meanwhile, the FTX issues do not seem to be ending anytime soon, as Caroline Ellison and crew just got rug-pulled with leadership bans that'll last almost as long as a bear market. That's basically an entire altcoin cycle of being sidelined.

And speaking of bears turning into bulls, someone might finally be getting serious about crypto tax, as Congress is actually doing something bullish for once with the PARITY Act. This should give HODLers some much-needed gas fee relief on taxes

Here are the Highlights:

- Coinbase Sues Three States Over Prediction Market Regulation

- SEC confirms years-long director bans for former Alameda, FTX executives

- US Lawmakers Propose PARITY Act to Overhaul Crypto Tax Regulations

- Google is secretly bankrolling a $5 billion Bitcoin pivot using a shadow credit mechanism

Coinbase Sues Three States Over Prediction Market Regulation

Coinbase has filed federal lawsuits in Connecticut, Michigan, and Illinois, challenging state attempts to block prediction markets and noting that federal regulators hold exclusive jurisdiction over the trading platforms. The crypto exchange filed complaints seeking declaratory and injunctive relief against state gaming regulators, saying that prediction markets fall squarely under the Commodity Futures Trading Commission's authority rather than individual state gaming boards. "State efforts to control or outright block these markets stifle innovation and violate the law," Coinbase Chief Legal Officer Paul Grewal tweeted Thursday.

SEC confirms years-long director bans for former Alameda, FTX executives

Former Alameda Research CEO Caroline Ellison and former FTX executives Gary Wang and Nishad Singh will be barred from assuming company leadership roles for eight to 10 years following a court judgment. In a Friday notice, the US Securities and Exchange Commission said that it had obtained final consent judgments against Ellison, Wang and Singh for their roles in the misuse of investor funds at FTX from 2019 to 2022. The former Alameda CEO consented to a 10-year officer-and-director bar, while Wang and Singh consented to eight-year officer-and-director bars each.

US Lawmakers Propose PARITY Act to Overhaul Crypto Tax Regulations

On December 20, a bipartisan pair of US lawmakers introduced new crypto tax legislation to modernize the emerging industry. The bill, called the Digital Asset PARITY Act, was sponsored by Reps. Max Miller and Steven Horsford. The legislation proposes to close the industry’s most lucrative “wash sale” loophole in exchange for significant tax relief on staking rewards and everyday payments. The bill’s most financially consequential provision is the application of “wash sale” and “constructive sale” rules to digital assets.

Google is secretly bankrolling a $5 billion Bitcoin pivot using a shadow credit mechanism

Search engine giant Google has emerged as a silent architect behind Bitcoin miners' rapid pivot towards artificial intelligence (AI). Instead of acquiring mining firms, the Alphabet-owned company has provided at least $5 billion of disclosed credit support behind a handful of BTC miners' AI projects. While markets often frame these announcements as technology partnerships, the underlying structure is closer to credit engineering. Google’s backing helps recast these previously unrated mining companies as counterparties that lenders can treat like infrastructure sponsors rather than pure commodity producers.

Other Highlights Worth Mentioning

Nearly 50% of all XRP Supply is Now in Loss as Price Settles Under $2 - BeInCrypto

Bybit relaunches UK platform via Archax under FCA promotion rules - Cointelegraph

Hong Kong proposes new rules to tap insurance capital into cryptocurrencies - Coindesk

Crypto trader loses $50 million in address poisoning attack, offers $1 million bounty for return - The Block

COINIGY FACT OF THE DAY.

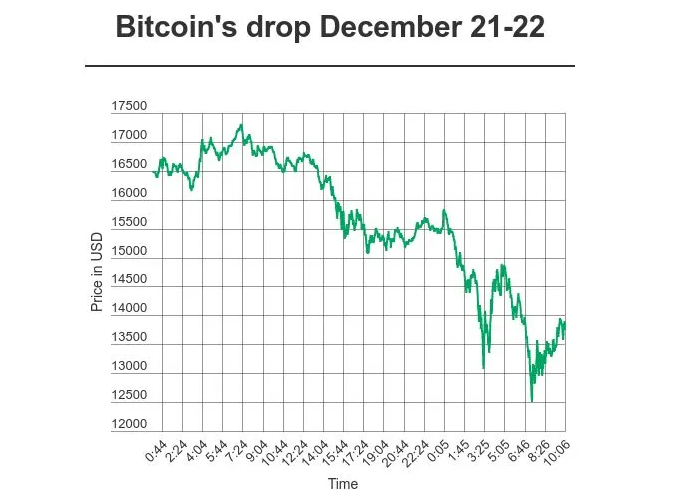

On this day in 2017, Bitcoin experienced one of its most dramatic single-day crashes, plummeting nearly 30% from approximately $16,000 to below $12,000.

Just five days after reaching its then all-time high of nearly $20,000 on December 17, the cryptocurrency shed over $4,000 in value, marking the highest percentage loss Bitcoin had seen that year. This sharp correction signalled the beginning of what would become known as 'Crypto Winter'—a prolonged bear market that would see Bitcoin eventually fall to around $3,100 by December 2018, an 84% decline from its peak. The crash affected the entire crypto market, with Ethereum down 20%, Bitcoin Cash down 30%, and Litecoin down 21% within 24 hours.

COINIGY MEME OF THE WEEK