The Connected Decentralized Space

The cryptoasset space is founded on the principles of decentralization, trustlessness, and openness. But just how 'connected' are all of these projects that are building the foundation for a decentralized future?

The Coinigy Insights team examined the indirect connections that different projects have through their venture capital partners and other backers. It’s important to note first that this piece is not intended to shame or promote any given project just because they are well-connected or not. This piece is solely aimed at providing insight into the connections of various projects that may not be immediately recognizable to many people.

To start, we first collected a list of some of the largest and most prominent firms, in particular venture capital firms, that have publicly announced their partnerships with and/or investments in cryptoasset projects. These firms include:

Taking this list and analyzing it over a week-long period mid-July, we identified 996 individual investments across the 33 firms. This research was conducted by pulling public information through firm websites and listed portfolios, project blogs/websites, and various research aggregation sites.

An interesting detail to immediately note is that 364 (36.8%) of these individual investments stemmed from just five of the 33 firms: #Hashed, Blockchain Capital, DCG, Pantera, and Wachsman. This could stem from the fact that these are some of the most well-backed and funded of our set of firms which would lead to a) them making more investments and b) them being more likely to disclose funding rounds and investments that they have made to their own investors.

Of the 996 total investments, we were able to identify over 600 unique projects that that these investments were spread across between 2014 and 2018. To further explore this data, we took a look at how many times each project appeared in our list of investments by each firm. The distribution was as follows:

- 420 projects appear exactly 1 time in our list

- 105 projects appear exactly 2 times in our list

- 35 projects appear exactly 3 times in our list

- 24 projects appear exactly 4 times in our list

- 14 projects appear exactly 5 times in our list

- 11 projects appear exactly 6 times in our list

- 1 project appears exactly 9 times in our list

- 2 projects appear exactly 10 times in our list

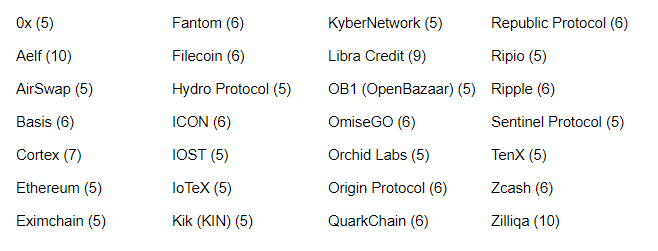

As one can see, some of these projects appear quite a few times on this list. These projects range from funds investing in other crypto-focused funds, to decentralized infrastructure projects, to protocol developers, and so on. To visualize just how interconnected these top few projects are, we took any project that appeared at least five times (i.e. investments from at least 5 firms), which includes:

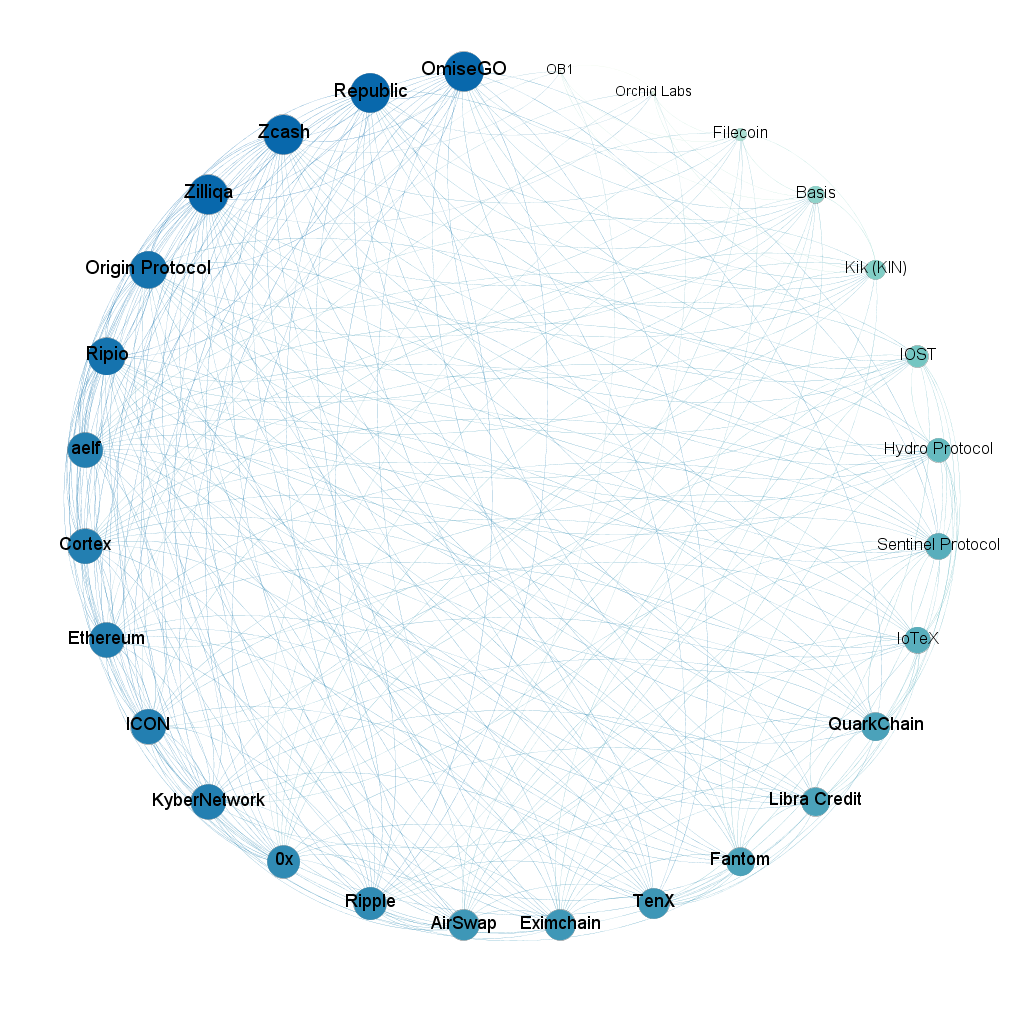

… and mapped them against other such projects with which they shared firm investors/partnerships, like so:

Click here to visit the graph in an external tab. For reference, the basic GML file for this network graph can be found here.

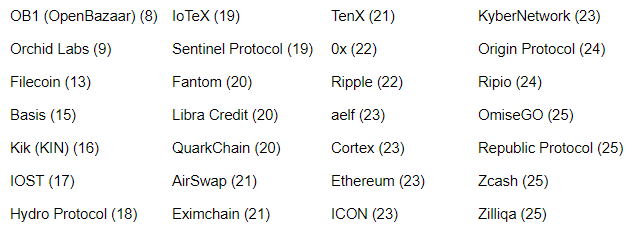

The above graph shows there is quite the variability in the number of firm connections between projects. It features 282 unique connections between projects with the minimum (OB1) being eight connections and the maximum (OmiseGO, Republic, Zcash, and Zilliqa) being 25. From minimum to maximum, the full breakdown includes:

Of course, given the fact that we chose some of the most well-connected and known projects across some of the most prominent firms in the space, such a large number of these connections was to be expected. Keep in mind that this representation only looks at the top 28 of the over 600 projects we were able to come across.

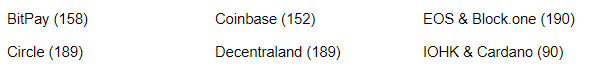

Some of the unique connections that other popular projects and companies have across partner firms (among all projects, not just the above 28) include:

...among many others.

So, why does all this matter?

Well, remember, this is all publicly disclosed information by the partner firm or individual project. With that in mind, that poses a couple questions:

- What other connections exist that we don’t know about?

- For better or for worse, how can these connections be utilized between projects moving forward?

We are not arguing to push these firms into disclosing their involvement in the space. They are private firms and have their own disclosure policies to abide by, as do many of the firms they are directly investing in or partnering with. What we do want to promote is the idea that retail investors should be pushing for projects building decentralized infrastructures to disclose what outside involvement they have utilized. While we are not saying such involvement is “bad”, it is nearly impossible to truly build trustless, open applications and protocols if the people and development behind them are not open too.